Accounting Definitions Book Value . book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. Salvage value is the book. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. book value is a company’s equity value as reported in its financial statements. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value is an asset's original , less any and charges that have been subsequently incurred. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. The book value figure is typically viewed in. Book value is calculated by.

from www.tickertape.in

The book value figure is typically viewed in. Book value is calculated by. book value is an asset's original , less any and charges that have been subsequently incurred. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. Salvage value is the book. book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. book value is a company’s equity value as reported in its financial statements.

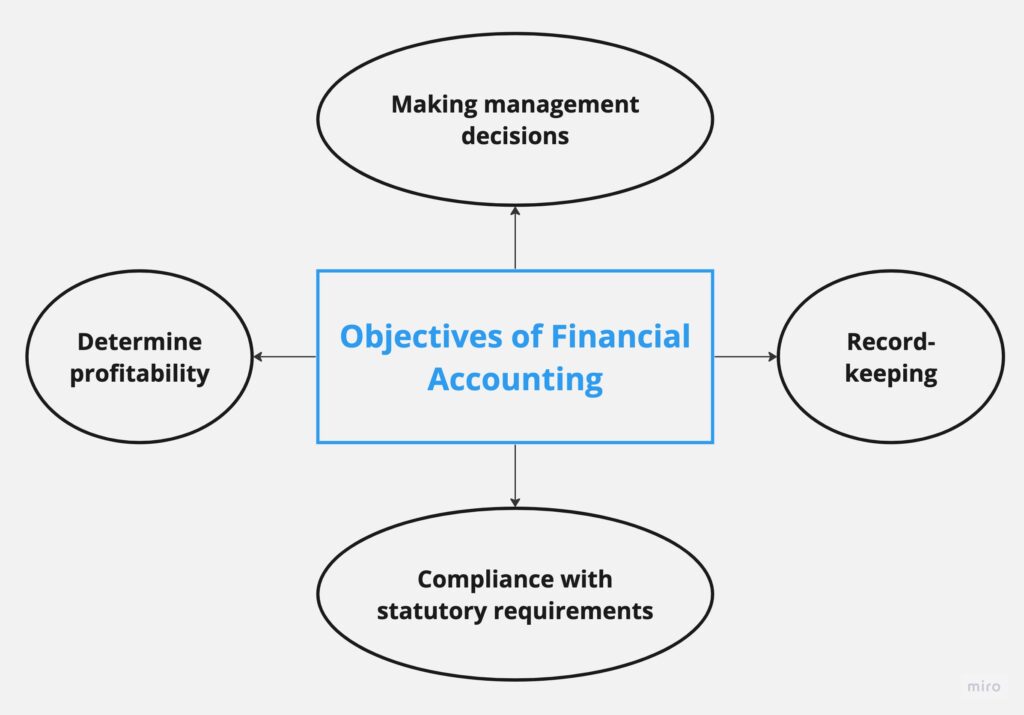

Financial Accounting Meaning, Objectives, Advantages, And More

Accounting Definitions Book Value book value is a company’s equity value as reported in its financial statements. Salvage value is the book. book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. Book value is calculated by. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value is an asset's original , less any and charges that have been subsequently incurred. book value is a company’s equity value as reported in its financial statements. The book value figure is typically viewed in. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation.

From www.wallstreetprep.com

What is Net Book Value (NBV)? Formula + Calculator Accounting Definitions Book Value book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. book value is a company’s equity value as reported in its financial statements. book value (or carrying value) reports. Accounting Definitions Book Value.

From www.slideserve.com

PPT Lecture 3 Internal Analysis Resources, Capabilities Accounting Definitions Book Value book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. The book value figure is typically viewed in. Salvage value is the book. book value is a. Accounting Definitions Book Value.

From pioneeraccountinggroup.com

Startup Accounting Basics 6 Confusing Accounting Terms — Pioneer Accounting Definitions Book Value book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. The book value figure is typically viewed in. Salvage value is the book. book value is a company’s equity value as reported in its financial statements. book value, also known as net asset value (nav) or carrying. Accounting Definitions Book Value.

From www.financepal.com

Bookkeeping vs Accounting What is the Difference? Accounting Definitions Book Value Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. The book value figure is typically viewed in. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. Salvage value is the book. book value is a company’s equity. Accounting Definitions Book Value.

From www.ignitespot.com

Basic Accounting The Accounting Cycle Explained Accounting Definitions Book Value Book value is calculated by. book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. book value is an asset's original , less any and charges that have been subsequently incurred. book value is a company’s equity value as reported in its financial statements. Salvage value is the. Accounting Definitions Book Value.

From www.wikihow.com

How to Calculate Book Value 13 Steps (with Pictures) wikiHow Accounting Definitions Book Value book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value is a company’s equity value as reported in its financial statements. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value is. Accounting Definitions Book Value.

From www.patriotsoftware.com

What Is Book Value? Definition, Purpose, & Calculation Accounting Definitions Book Value book value is an asset's original , less any and charges that have been subsequently incurred. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. book value is a company’s equity value as reported in its financial statements. book value (or carrying value) reports the value. Accounting Definitions Book Value.

From www.investopedia.com

Financial Accounting Meaning, Principles, and Why It Matters Accounting Definitions Book Value book value is an asset's original , less any and charges that have been subsequently incurred. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. book. Accounting Definitions Book Value.

From www.pearson.com

Edexcel International A Level Accounting Resources Accounting Definitions Book Value The book value figure is typically viewed in. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value is an asset's original , less any. Accounting Definitions Book Value.

From www.artofit.org

Bookkeeping vs accounting meaning differences and bookkeeper vs Accounting Definitions Book Value The book value figure is typically viewed in. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value is an asset's original , less any and charges that have been subsequently incurred. book value represents the value of assets and liabilities at the date they. Accounting Definitions Book Value.

From www.youtube.com

Accounting Terminology Accounting Terms in Hindi YouTube Accounting Definitions Book Value book value is an asset's original , less any and charges that have been subsequently incurred. Salvage value is the book. The book value figure is typically viewed in. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted for depreciation. book value represents the value of assets and. Accounting Definitions Book Value.

From www.scribd.com

Accounting Terms Basic Definitions Debits And Credits Expense Accounting Definitions Book Value Book value is calculated by. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. The book value figure is typically viewed in. Salvage value is the book. book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. book value. Accounting Definitions Book Value.

From www.bmsauditing.com

Accounting vs Bookkeeping What is the Difference? Accounting Definitions Book Value Salvage value is the book. Book value is calculated by. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. book value is an asset's original , less any and charges that have been subsequently incurred. book value (or carrying value) reports the value of an asset on. Accounting Definitions Book Value.

From 1investing.in

Comparing Book Value and Book Value per Share India Dictionary Accounting Definitions Book Value book value is an asset's original , less any and charges that have been subsequently incurred. Salvage value is the book. Book value or carrying value is the net worth of an asset that is recorded on the balance sheet. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that. Accounting Definitions Book Value.

From www.wikihow.com

How to Calculate Book Value 13 Steps (with Pictures) wikiHow Accounting Definitions Book Value book value, also known as net asset value (nav) or carrying value, represents the total value of a company’s. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. Book value is calculated by. book value is an asset's original , less any and charges that have. Accounting Definitions Book Value.

From in.pinterest.com

Golden rules of Accounting Explained with examples Accounting Accounting Definitions Book Value book value represents the value of assets and liabilities at the date they are reported in a company’s documents. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value (or carrying value) reports the value of an asset on a balance sheet, which is adjusted. Accounting Definitions Book Value.

From www.scribd.com

accounting Depreciation Book Value Accounting Definitions Book Value The book value figure is typically viewed in. book value represents the value of assets and liabilities at the date they are reported in a company’s documents. book value is an asset's original , less any and charges that have been subsequently incurred. book value (bv) is the total assets of a company minus its outstanding liabilities,. Accounting Definitions Book Value.

From mungfali.com

Accounting Accounting Definitions Book Value Salvage value is the book. The book value figure is typically viewed in. book value (bv) is the total assets of a company minus its outstanding liabilities, representing the equity that would be. book value is a company’s equity value as reported in its financial statements. Book value or carrying value is the net worth of an asset. Accounting Definitions Book Value.